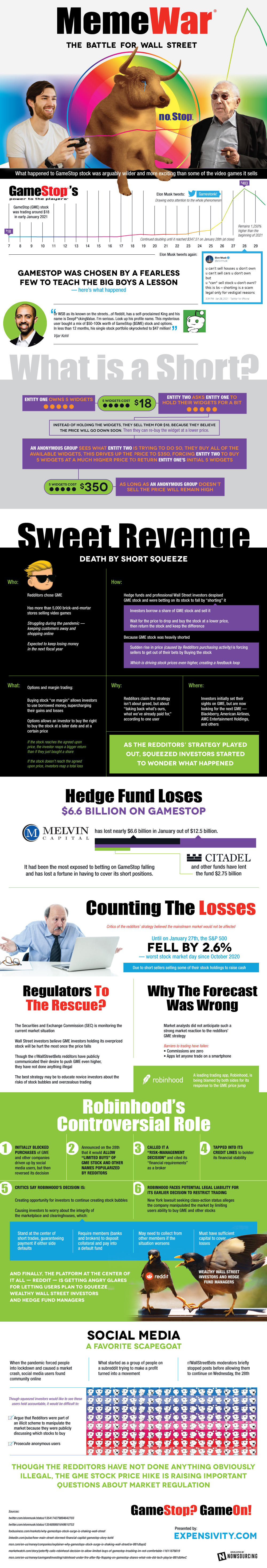

Anyone interested in finance and stock trade is familiar with the sudden, inexplicable rise of GameStop stock in early 2021, but you may not be intimately familiar with the details of how it all went down. It’s definitely a story worth hearing.

In early January of 2021, GameStop stock was selling at about 18 dollars a share. The brick and mortar video game company had been struggling for a long time and, for some shareholders, it seemed like a safe bet that this particular stock was primed for pulling off a “short.” This basically means that borrowed stock is sold at the current value, with the expectation that the stock price will soon be dropping. Then the borrower will be able to purchase the same share at a lower price, thus making a profit right under the stockholder’s nose. While this move isn’t illegal, it is certainly morally questionable.

In the case of GameStop stock, a small group of small-time investors in a Reddit group noticed what was happening, and they decided this was their opportunity to teach the “big boys” a lesson. These redditors bought up all the GameStop stock, which of course created a higher demand and therefore drove up stock prices astronomically. From the beginning of January to January, GameStop stock had risen from $18 to $483 dollars a share, which was an increase of 1,250%.

Not only did this move mean hedge fund losses of $6.6 billion, but on January 27th, the S&P 500 fell by 2.6%. Unfortunately, there’s still no clear answer as to what these actions and events all mean for the future, but it’s clear that legislators need to take a long, hard look at market regulations.

Learn more about the GameStop short squeeze in the infographic below:

SME Paid Under